A disclaimer: I don't work in the finance industry so have certainly gotten some details wrong. Also, most of these companies no longer exist, limiting how much information is available.An Unnecessarily In-Depth Review of Don’s Resume

By WhereDoesDaddySleepDedicated to anyone who’s ever applied to their dream job, only for the position to be filled by somebody’s underqualified cousin.Summer 2001 - March 2012: Intern/Algorithmic Trader/Unit Leader at GetcoCo-founded by Daniel Tierney, Poopsie's (step) nephew/Don's cousin. Daniel once worked as a clerk for Poopsie on the Chicago trading floor, so they had a longstanding professional relationship. Poopsie worked at Getco as a trader until 2002 when he was named CEO, eventually being

"pushed out" in 2005.

Don joined the company straight out of high school in 2001 as an intern. A few months later he was hired full time as an algorithmic trader, for which he deferred university

a. He likes to say this is because he’d learned Getco’s proprietary software. IMO this is him rationalizing how he, an under-qualified 18-year-old with multiple family connections in a ten-person company, was hired for a competitive, highly-compensated role.

But, it’s also a claim that’s created confusion about how Don made so much money so young. To make sense of it, you need to understand high frequency trading (HFT). I'll let

reddit explain:

QUOTE

High frequency trading (HFT) uses algorithms or scripts in specialised trading software to trade automatically within the time frame of a few milliseconds.

Individual traders making individual trades are not what drives HFT; instead they focus on tweaking algorithms (which I'm guessing Don would do via Getco's software) to find new opportunities within the market, then exploit those opportunities at scale

b.

So what’s the issue with HFT? Here is a nice analogy from

“What Ails Us About High Frequency Trading”:

QUOTE

Imagine you are at the grocery store. You take your cart to one of the five apparently empty checkout lines. Suddenly, nine carts instantaneously appear ahead of you. You scratch your head and move to lane two. The same thing happens. You soon find that whenever you move into a new lane, a multitude of carts appear ahead of you in line. Why? Because the supermarket has sold the right for those carts to do so. Thus, you can never be at the head of the line, no matter what you do, short of paying the exchanges a large fee to have the same right to cut someone else. In real life, this enabled HFTs to turn around and buy or sell stock to you for a penny or two more or less than the market was before you submitted your order.

A penny or two more across millions (even billions) of trades a day - you could make good money! And Getco did. In fact, they made

loads of money while it was still easy.

The field soon flooded with competitors. Firms would spend hundreds of millions to shave nanoseconds off connections to markets. Computational methods became more sophisticated and hiring standards rose.

Quantitative traders, people who use advanced mathematical and programming models, became the norm. A master's degree--or even PhD--in math or computer science was required. The big players recruited from MIT, Stanford, and Harvard

c.

Through it all, Getco remained a leader. To provide some context, this is how an industry analyst

described Getco's market position in 2009:

QUOTE

The human leverage in a firm like this is amazing - less than 250 people, in 1 firm, account for 10 to 20% of the daily trading volume in many US stocks. Think about that for a moment... how concentrated the power is; and this company is only 10 years old.

That analysis was based on a

WSJ article that provided a rare glimpse into life at Getco:

QUOTE

At Getco, traders stare at enormous high-definition screens stacked to the ceiling that display trades in virtually every financial instrument traded electronically on exchanges. Large white boards, thick with scribbled formulas and intricate diagrams, line the walls of its expansive trading hub on the second floor of the office tower that houses the Chicago Board of Trade.

Unlike traditional Wall Street firms, the company holds relatively few securities by the time markets close for the day. Nor does it use much leverage, or borrowed money, to amplify the effects of its trades.

Since it constantly buys and sells, it can move in and out of hundreds of millions of dollars' worth of securities every day with a relatively small amount of capital. It favors shares that are the most heavily traded.

There was no selling of software; there was no commission made from investing clients' money; Don was just compensated

unusually well from the age of 18 by a firm that was

doing unusually well

d. Not only in terms of paychecks, but also stock. The equity alone, as one of the first employees, would’ve made him very wealthy

e.

I’ve skipped Don’s education. He's said he would've preferred working full time, but his parents pressured him to get a degree. He enrolled at Northwestern and majored in Learning and Organizational Change at the School of Education and Social Policy

f. He rarely attended class and graduated in three years while working part-time.

Don parted with Getco in March 2012. I'll

let him explain why (emphasis mine):

QUOTE

I mentioned I left my former employer, the trading firm, earlier this year...

a couple of years ago I stopped trading full-time and I went on this kind of, you know--company never used the word "management"--but the leadership/management track, and I had different management-type jobs and eventually there were actually quite a few people that I was responsible for...I started to kind of read a lot about modern management theory (and this is actually what I had studied at Northwestern, my major was called learning and organizational change)...as I kind of

reconnected with some of those books, really get excited and kind of passionate about ideas related to how the dynamics of organizations are changing in the modern economy because of the way

technology really changes everything [ed.

groundbreaking] and so I developed, I guess, some somewhat

radical ideasg about how management should work now and in the future and I thought you know that maybe the trading firm was going to be a great place to to test out those ideas, but ultimately myself and the founders and senior managers there--we decided

we weren't on the same page and parted very amicably.

Don likely signed a non-compete preventing him from taking a similar role for 6-12 months (a standard practice in the industry). He would’ve been given a hefty payoff in exchange

h. So yes, I would say they parted very amicably.

In the end, it was good timing: in June 2012,

Getco cut 10% of its workforce after a

nosedive in profits. The next year it

acquired and merged with a struggling competitor. The newly-formed company (KCG Holdings) could never replicate its early success and was itself acquired in 2017.

Important to note, the title of “broker”/“trader” is regulated in the US and requires certification. There’s a two-year grace period when you change jobs: if you’re working as a broker again within this timeframe, you maintain the cert without re-testing. So the non-compete I’m assuming Don signed wouldn’t have prevented him from finding a similar job before his certification expired.

Notes

a. Don discusses his time at Getco most completely in "Vlogust 2012, Day 8: Chat with Don & Park City Date (2012-08-09)". I've edited it down to the relevant parts, because you deserve to not waste as much time on this as I have.

b. This is a gross oversimplification; Michael Lewis's Flash Boys is one of the few detailed resources (and might even be directly related to The Poop--and yes, Don has read it.) In any case, it doesn't matter: “‘It has got to the point where the speed is so ubiquitous that there really isn’t much left to get.’”

c. This forum thread is from 2013-14, but it does discuss Getco's historical hiring standards.

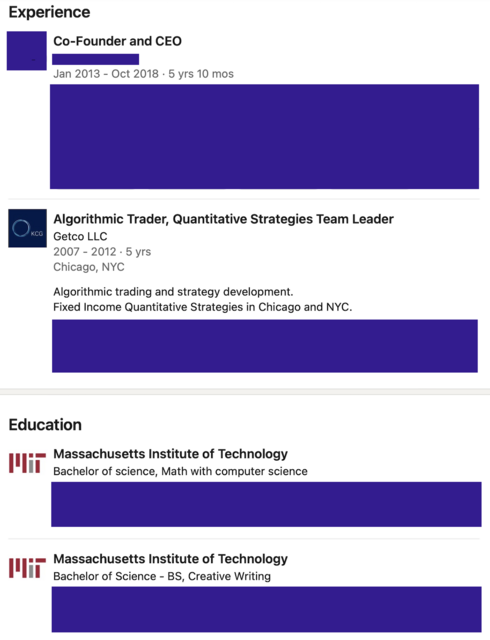

As a point of comparison, here's the LinkedIn profile of one of Don's counterparts. I anonymized it before realizing she's given interviews about her time at Getco (which I'll get to).

In any case, notice her degrees in math and creative writing from MIT (she attended on a full ride) which she supplemented with many activities, including a stint working one summer in tech in Israel. She left Getco in 2012, but unlike Don, went to Silicon Valley to start her own company. She's since sold and now focuses on angel investing and various creative pursuits.

I cannot imagine what it was like for someone like her to work with someone like Don.

d. The above-mentioned counterpart told Forbes she made $1m her first year, with the caveat that it wasn't the norm. Additionally: "According to filings, Getco’s all time peak average compensation per employee was $1.688 million in 2008".

e. In September 2009, Forbes discussed Getco's value and employee ownership: "General Atlantic reportedly paid $200 million to $300 million for 20% of Getco (Tierney, Schuler and employees own 80%) in 2007."

f. No idea why he chose this program, rather than something relevant to his field like math. Northwestern's Kellogg School of Management doesn't offer undergraduate degrees, so maybe it's a popular alternative. You can find the curriculum in the 2001-03 Northwestern Undergraduate Catalog.

g. Don lectures on his theories in this DisorganizedDon video. He mentions Maslow's Hierarchy of Needs, in case that's all you need to know.

A highlight @19:42: "I don't go to meetings if they don't align with what I really love and what I feel like I'm really good at."

h. Back to Don's accomplished counterpart: "But when I left Getco in 2012, they enforced a non-compete where they paid me a lot to do nothing for a year." And in 2015 Getco was involved in litigation with a former employee who signed a six-month non-compete paying him $1m.

(There aren't this many footnotes going forward, I PROMISE.) April 2012 - September 2013: Chief Operating Officer at Advisor Exchange

April 2012 - September 2013: Chief Operating Officer at Advisor ExchangeAE was a platform providing brokers a comprehensive view of their client’s data--think YNAB (you need a budget) for professional use. It was founded by Poopsie in 2005 after his ouster from Getco; he was joined by Weatherman Dave in 2006 and Don in 2012.

Don got vulnerable and discussed his leadership PoV while at AE in the above-mentioned

DisorganizedDon video (@22:16):

QUOTE

...there's opportunity for all of us to do what we love and to to get paid for it...

the conventional wisdom that we have about work is that it has to be valuable to someone else [ed.

That's literally how markets work

] …I just believe that it's time to stop thinking that way...now

my wife and I really are in a place where we can look at that and we can say,

I only want to do things if I love them...

What I do want to share is my personal, kind of my aspiration, for my company. And, yeah, I've

shared this with the people in the firm and videos that I've produced for them [ed.:

lol], but I just believe that everyone should have a job like that [where you only do things you love]. I believe that everyone should have a job that allows them to achieve self-actualization, and I think that it's possible today. It's obviously not possible this millisecond, it's not in this universe, it's not going to happen tomorrow--but

there's nothing about the state of the universe today that makes it impossiblei. We just have to start working towards it. We have to startthinking differently about what we value, and what makes business work...

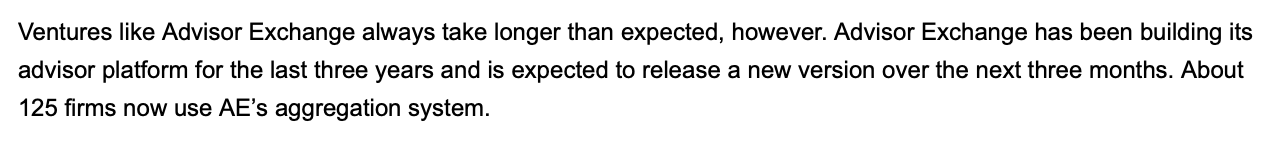

Don would later explain that they shut AE down because development was more expensive than anticipated:

Based on Don's comments, you’d think the company wasn’t very successful. But by 2009, long before Don joined, Poopsie

had this to say:

My suspicion is, in spite of his title, Don wasn’t exactly necessary to operations. Comments from Guru Gossip at the time confirm this impression, noting that Don is often shown sitting around, cooking for his princess, and golfing.

Never mentioned by Don is that the business was sold to their VP of Sales and Business Development, a non-Ross, who

renamed it Aqumulate. Interesting that

he was able to take the business and grow it, selling in 2019 and starting a new venture.

Don was not working as a trader during this time. After his assumed non-compete, he seems to abandon the profession.

Notes

i. He's, like, a bowl away from arguing for Universal Basic Income

April 2, 2013 - July 10, 2013: "DisorganizedDon" on YouTubeDon's brief YouTube career. I told you he wasn't necessary to operations. Right, Jen?

In comments, Don refers to himself as a "retired trader turned YouTuber" and also says, "I was a trader for 10 years but I retired from that last year. Now I am working on a software company with my father."

DisorganizedDon came to be around the time Jen decided she wanted a baby, to give you a view into their home life.

Don gives up when he realizes making videos is hard and the viewers aren’t going to kiss his ass the way he does Jen’s. Probably. (OR maybe he decided it was time to job hunt? 🤔)

October 21, 2013 - December 2014: Strategic Product Manager at Title Trading ServicesLike Getco, Title Trading (TT) described itself as a proprietary trading firm; however, they didn't operate anything like Getco. As an example, while Getco seemed to follow a standard pay structure of base + bonus + equity, TT traders earned commission only. In terms of hiring, TT didn't require a degree, made a big deal of their training program, and recruited on Craigslist.

This was very confusing until I realized there are multiple definitions of "prop firm". To quote

a veteran of the TT sort:

QUOTE

The most basic definition of proprietary trading is trading to make a profit rather than earning a commission or trading on behalf of clients. Proprietary traders can be hedge funds, banks, brokerage firms, or many other types of institutions. The firms use their capital to engage in trading to make a profit.

In this article, we refer to proprietary trading as a firm that facilitates remote or on-site trading for small individual traders.

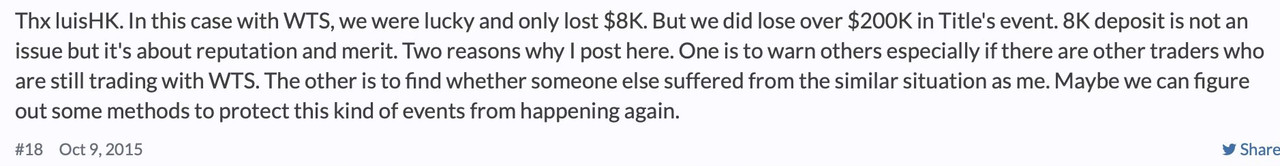

To cut risk, prop shops like this will ask a trader to give them what is essentially a deposit. If the trader loses company funds, it comes out of the deposit. Based on forums, it seems uncommon for this number to be less than $5000

j. However, TT promised on its website not to require a deposit, which to me is just as sus.

Shockingly, this Glassdoor reviewer claims that--out of the people he trained with--nobody made money. These concerns are countered with "you get what you put in" victim-blaming bullshit; it's big MLM energy, but instead of stifled homemakers, they were targeting overconfident, underemployed men.

TT also advertised the opportunity to be an "affiliate". I think this meant having the privilege of using their trading platform to trade your own money. Which would be held by TT, which is how

this person alleges he lost $250k when TT stopped paying him out

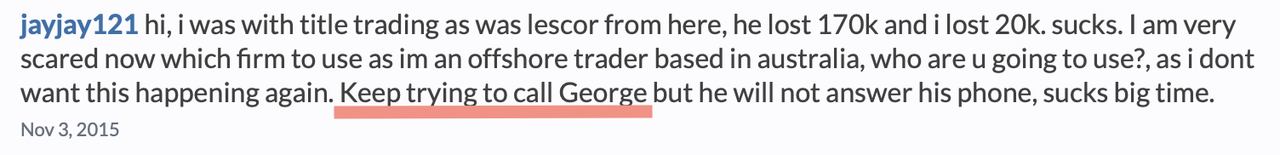

k:

In any case - Don wasn't a trader, he was, as far as I can tell, a

software product manager. He was also allegedly

tasked with setting up a satellite office in Chicago, presumably to recruit more commission-only "traders".

TT sued a former employee in 2014. The

complaint provides detail on the "legitimate" side of the business (they did develop a trading platform, after all):

QUOTE

Title Trading is a financial, technology, and principal trading firm that, among other things, employs traders to create strategies and trade Title Trading's funds in various securities markets utilizing those strategies. As a vital part of its business, Title Trading hires quantitative analysts (or "quants"), traders and developers to develop various proprietary trading strategies...

…Additionally, Title Trading is a technology company. Title Trading employs people with expertise in trading technology, including creating software...as well as hardware configurations, to be used in conjunction with the deployment of Title Trading's trading strategies. Thus, Title Trading will often instruct employees with expertise in technology to work with employees developing strategies, to create a more effective way of automating the trading process for the Company.

See the bolded. Don likely fit somewhere in between these two roles: not a tech guy, not a quant, no longer a broker, but familiar enough with HFT to act as a bridge. He would be well suited to it--but this isn’t exactly the typical work experience of CEO candidates. (Full disclosure: I work in software. This is the Don job that initially set off my BS detector.)

TT disappeared in 2016

l. The allegations they were stiffing traders originate in a

forum post from May 2015m. According to Web Archive, the company removed all job listings from their site in October 2015. The last archive of the site is from September 2016. Apparently the trading platform they built wasn't worth anything; I haven't found evidence of assets being sold.

So yeah - that’s Don's famous non-family job! Interesting that

this is the organization that was willing to hire Don.

Then again: why did he need to work at all? Particularly in a role that would be a huge step down in terms of prestige, money, title, and, you know,

self-actualization potential.

In context of Jen’s “fertility” journey: Don started with TT shortly after Jen began acupuncture. She finally saw a fertility specialist a couple months before he left the company, and was diagnosed with uterine polyps soon after.

Additionally, “the poop hit the fan” in early 2014. It’s largely accepted this was related to HFT. I wonder if Don stepped back from trading due to fears for the future of the industry. Or maybe he knew he couldn’t compete in the job market against the Ivy-educated, math and computer science geniuses he’d worked with at Getco. But who knows.

Notes

j. I suspect these companies also nickel-and-dime on fees, e.g. charging $150 for a wire transfer.

k. To add some context: this user is Chinese, I believe, and seems to live in the US less than part time. He and other foreign investors used TT and similar prop firms (like WTS--which also stiffed traders and eventually was acquired) to participate in US markets. If prop firms run with foreign traders' money, they have no recourse other than to sound the alarm on forums. WTS (registered in the Cayman Islands with offices in Canada) heavily targeted Chinese investors, using Asian models in its marketing and offering their site in both English and Chinese. Stack this with language barriers and cultural differences - it seems very predatory.

FWIW Title Trading was registered in Cyprus as "Hainy Investments", and claimed at various points to have offices in Montreal, Mexico, China, Warsaw, and, of course, Chicago. Don likely knew they weren't a legit US-registered brokerage, yet he still took a job with them

l. In spring 2016 TT failed to file an annual report with the state of NC and their certificate of authority (permission to operate, essentially) was revoked the following year. Search "Title Trading" here.

m. The forum allegations are so sketchy, I was starting to think it was a different company, but then saw this post: "George" is the name of TT's CEO.

Speaking of George, CEO of Title Trading - he hasn't updated his LinkedIn since his business failed, but in 2017 he appeared in this YouTube video promoting some sort of "wealth retreat": QUOTE

"It was a wealth of knowledge. The amount of information we were able to absorb and learn over the two days is going to be invaluable for putting us on a course to creating wealth for us [inaudible]. So I highly recommend the program. If anyone has any doubt about taking it, my advice to you is sign up as quickly as you can."

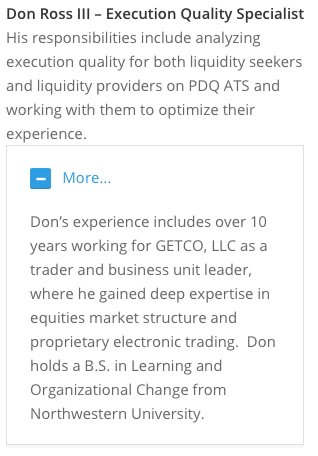

Sign me up  January 2015 - September 2016: Execution Quality Specialist at PDQ

January 2015 - September 2016: Execution Quality Specialist at PDQUnemployed, Don runs back to daddy.

PDQ was founded in 2003 by

Christopher Keith, a Wall Street veteran and inventor. He patented a software algorithm which was PDQ’s secret sauce. In 2006, he asked Poopsie to join as CEO. (It’s funny to me that what we know as the “Ross family business” wasn’t founded by a Ross.)

Once again, Don was not a trader. Frankly, based on the job description, this sounds like a highly-skilled customer support job.

Screenshot from July 15, 2016 - Don is still listed on the "Team" page rather than "Leadership".Jen had surgery to remove her uterine polyps in early/mid March 2015. She had delayed the procedure, even using Utah as an excuse

n. She is immediately knocked up; Charlotte is born in December 2015.

Don is seen increasingly less in Jen's videos...

Notes

n. For the timeline of Jen's conception journey, watch: "I'm Pregnant! | Preconception Journey & First Trimester Recap | July 13, 2015"October 2016 - December 31, 2021: CEO of Coda MarketsBoth Don and PDQ rebrand. Suddenly, Don has spent the past 21 months as PDQ’s “Chief Strategy Officer”. Ok Don. Strategies for justifying nepotism hires, maybe

o.

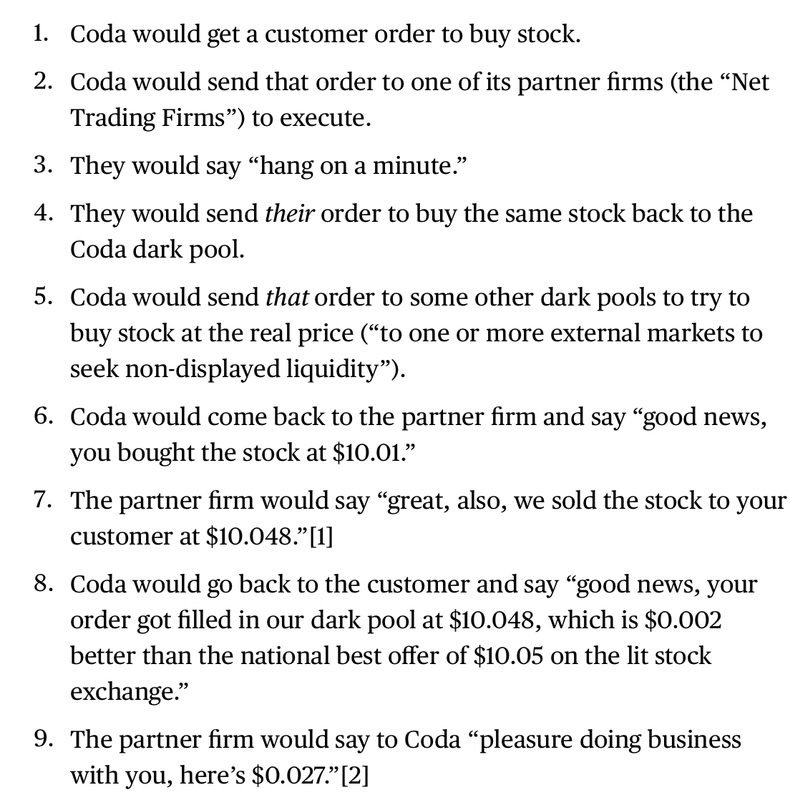

This was the beginning of the end: according to SEC filings, Coda would kick off its illegal circular routing scheme in December 2016, which would account for 30% of revenue. Don would say he had no knowledge of the fraud; Coda’s President (an actual broker) would claim responsibility

p, receiving a fine and a hand slap.

Which isn't great, because Don is either lying or a

really bad CEO.

If you have no idea what I'm talking about, Coda colluded to raise prices for customers and pocket the difference. This screenshot lays it out; it's from

this Bloomberg newsletter (which is an excellent read):

Of course, it's also the beginning of the end for Don and Jen's marriage. They separate around September 2019 and Jen files for divorce in January 2020. Don is a free man again just before Thanksgiving.

Notes

o. In the announcement of his promotion, Don claims that at Getco, he served as "head of North American equity trading" and implies he oversaw 60 people. Yet "the company never called it management track". Hmmmm...

He also attempts to claim ownership of the PDQ ATS (Alternate Trading System, aka a dark pool), which had existed since at least 2006.

To be fair to Don, I did find one interview from March 2016 where he's referred to by his new title.

p. Only a registered broker could be held reponsible by the SEC:

QUOTE

...a registered principal is someone who holds a position in management in a securities or investment company. A registered principal must hold a principal license and since they also function in securities dealing, they must also possess some of the most basic securities licenses. These individuals are legally liable for any problems that occur in their firms and, as such, must be registered with regulators at the state and/or federal levels.

January 2022 - February 2023: General Manager at ApexCoda was acquired by Apex on December 31, 2021. We don’t know why, but considering the millions in fines they were hit with by the SEC and FINRA, and the

large amount of cash broker-dealers are required to maintain, a reasonable guess is they were running out of money

q.

Well done Don. Glad you got a chance to test out your management theories

I know I initially scratched my head at what Apex would want from Coda, but its pretty simple: it's a

dark pool, aka a non-public stock exchange. "Dark" because there's limited information on what happens there (though regulation and reporting requirements have increased significantly). It's the type of thing that's difficult and expensive to build from the ground up--and from what I've read, PDQ/Coda hosted a

not inconsiderable share of trades.

Don stuck around to launch a rebranded version of Coda for Apex customers, which they are now heavily promoting.

And get this--Apex's

ad campaign for the rebranded Coda Markets is DIVORCE THEMED:

Zoomed in for the hard of sight:

(Not saying this is significant. It's just a

weird choice!)

Don left Apex ~6 months later. According to LinkedIn, he's now devoting his time to "self study".

Notes

q. In 2015 PDQ bought a competitor in this very scenario. Note this deal took less than six months.—-

I keep emphasizing that Don hasn’t worked as a trader since leaving Getco - how do I know this? Because he’s no longer listed on BrokerCheck. BC is a service from FINRA (an industry regulator) to help people make informed choices about the brokers they work with. The site only keeps records of people who’ve been active within ten years, unless there’s something of note in their history, e.g. Poopsie is still listed because of two disciplinary actions from the 90s.

I noticed that Don was no longer listed in February 2023. He left Getco in March 2012, so he could have been expunged some time last year.

Which begs the question: was Don even qualified to serve as CEO of a brokerage? I don’t have a screenshot of Don’s former BC profile, but IIRC it was pretty bare with just the minimum certs. If you look up brokers still employed by Apex, they’re regularly pursuing additional certifications as their responsibilities increase. Even Coda's President/longtime PDQ employee who took the fall for the circular routing scheme has pursued further certification, as recently as January 2023!

My conclusion: Don was ill-equipped when he stepped into his roll as CEO of a brokerage, with limited respect for industry standards and no relevant work experience.

Furthermore, comparing Don to his colleagues provides a contrast in ambition and professional commitment. For all his interest in trading, he didn’t seem to excel as a trader. You’d think an algorithmic trader--Getco’s THIRD no less--would be in high demand, but no. Nothing about Don's resume indicates that.

It's almost as if excelling at something requires doing things you don't

love...